Omnibus Survey Series

The Future of Personal Finances: Insights into Banking, Saving, and Investing

As financial security becomes harder to hold onto, understanding consumers’ choices and values is more important than ever. Their decisions often reflect a need for stability and trust. By recognizing their concerns and priorities, we can provide meaningful solutions that support their goals and build stronger, lasting relationships.

Our latest omnibus survey connected with over 3,000 adults across the U.S. and Canada to uncover how they’re saving, investing, and choosing their financial partners. From the rising influence of retirement planning to the role of family in financial advice, this report highlights the real priorities and challenges people face today.

Whether you’re looking to deepen relationships with your customers or stay ahead in the financial landscape, these insights are here to guide you. Explore what matters most to the people you serve.

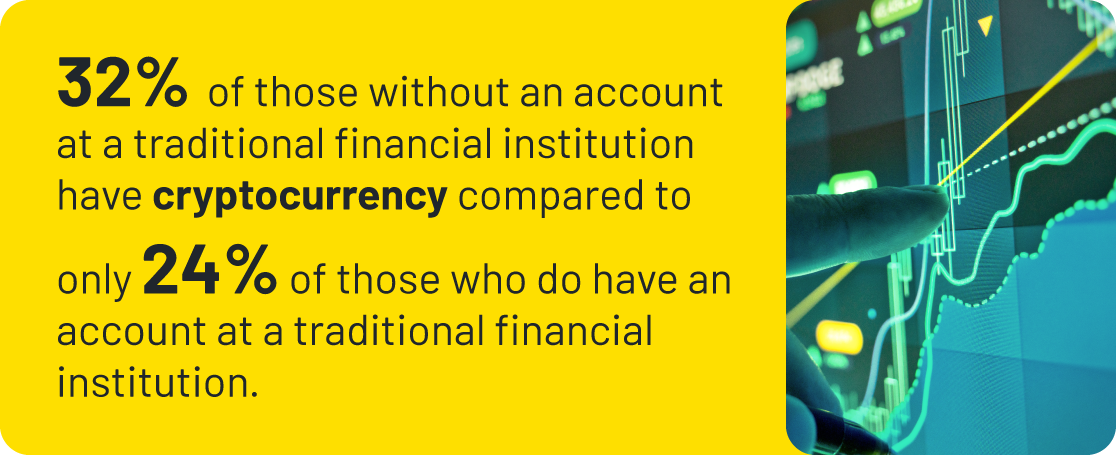

94% have an account with a bank, credit union, or similar financial institution

59% Have at least one type of investment account.

Retirement accounts are the most popular type of investment.

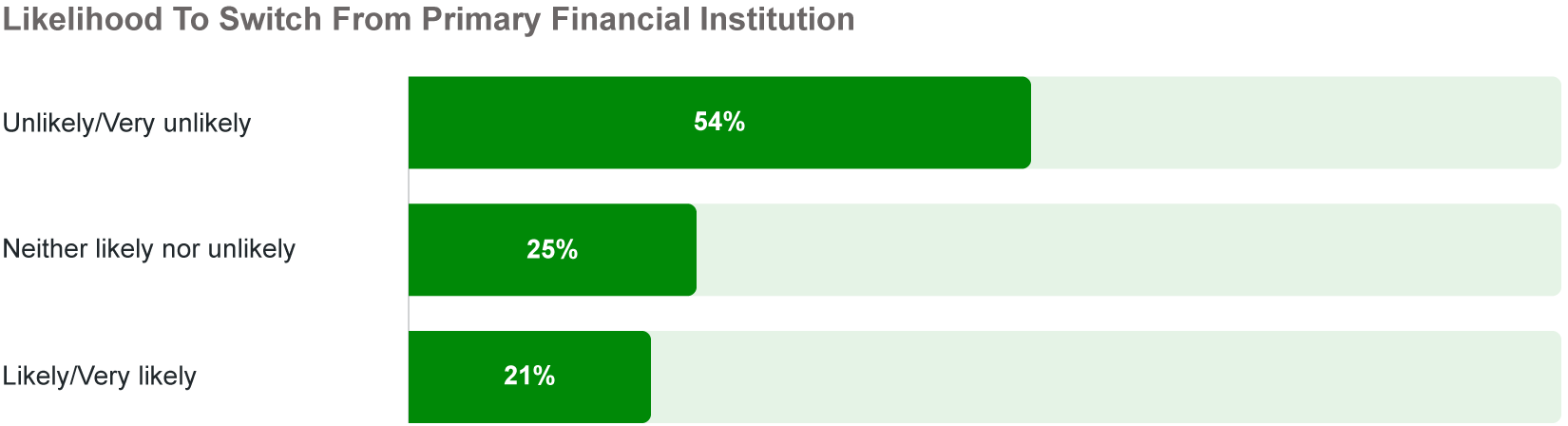

Most people aren’t planning to switch from their main financial institution, but one in five consider themselves likely to in the next 12 months.

Switching is more likely if they had concerns about their bank’s values or a breach involving their personal information.

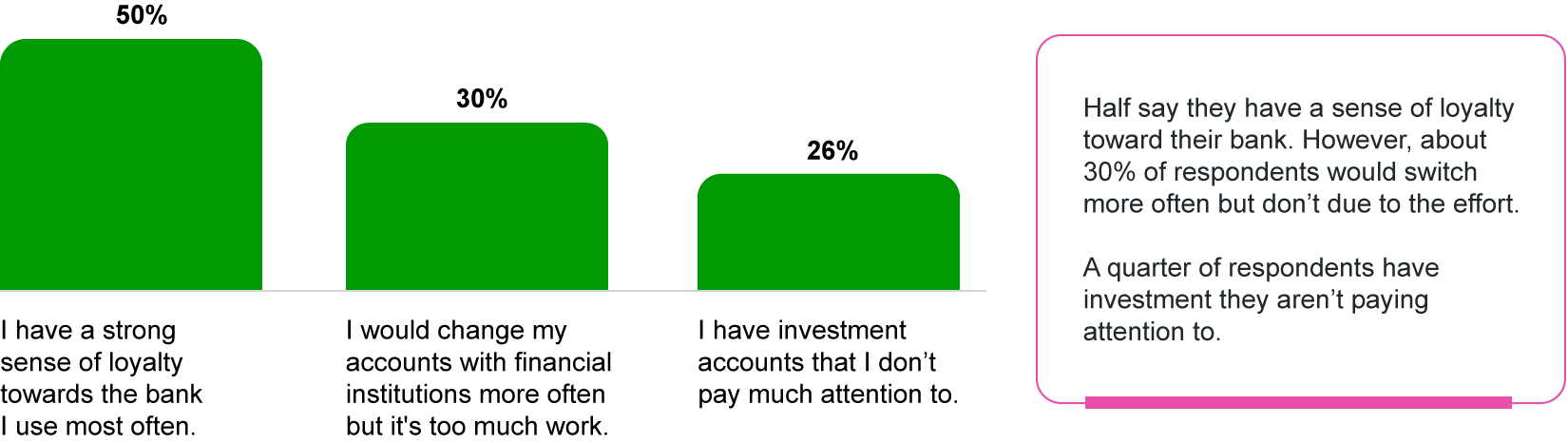

There is a sense of loyalty to their bank, but some stay due to the additional effort to change.

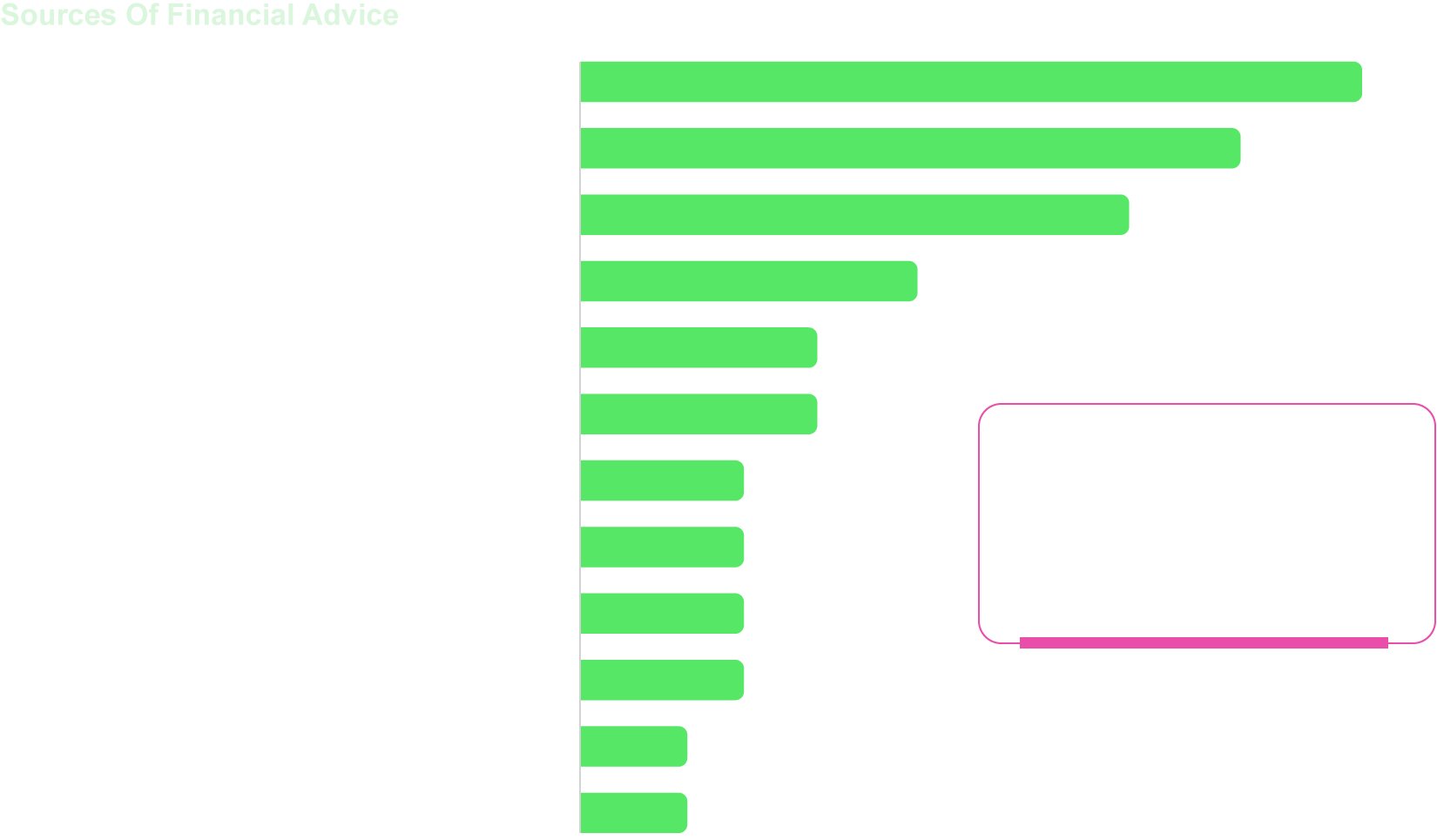

Respondents said their financial advice is most likely to come from friends and family members.

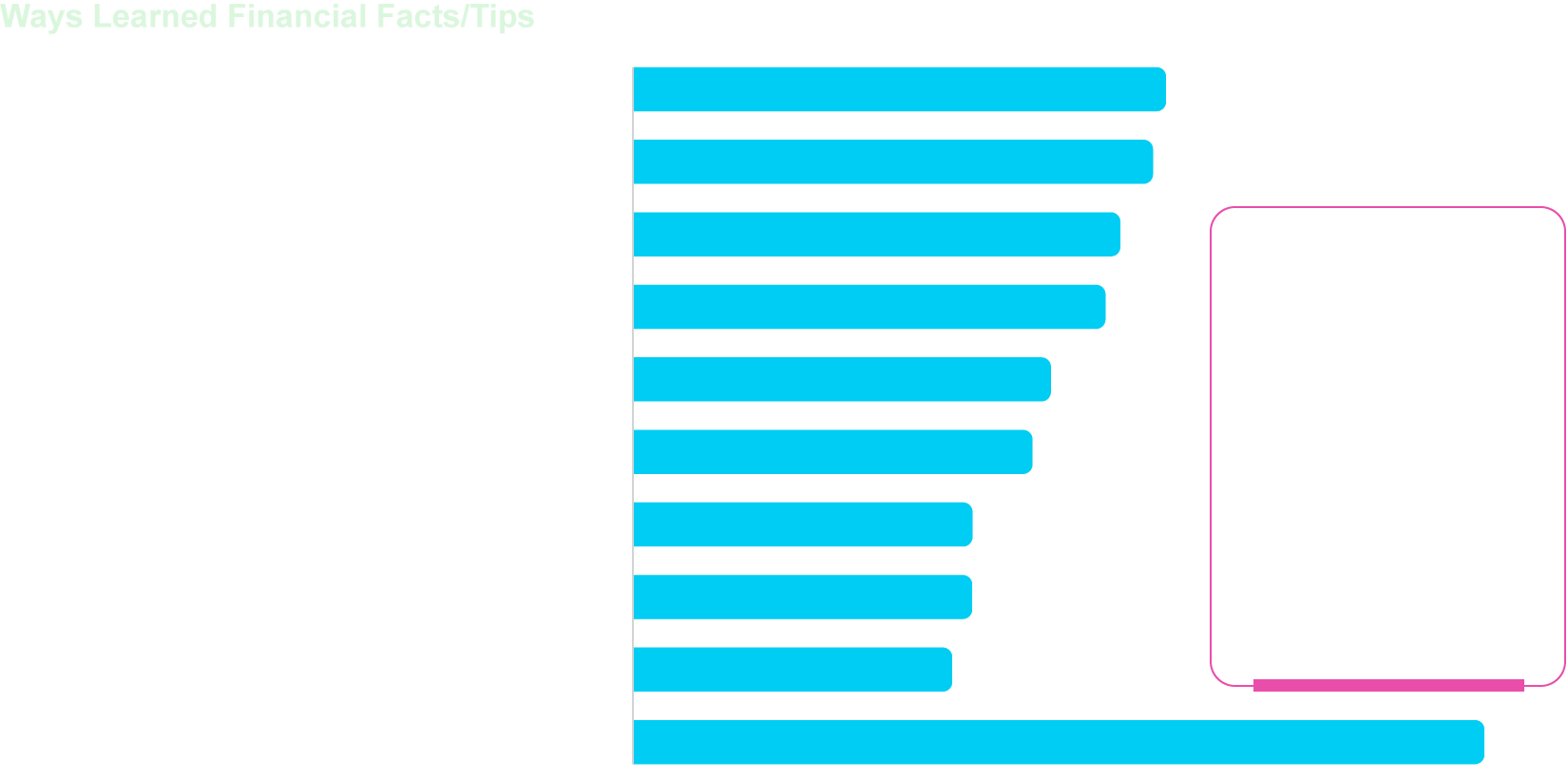

Many people aren’t learning or seeking information to support their finances, but when they do, it is directly from a financial institution or longer social media videos.

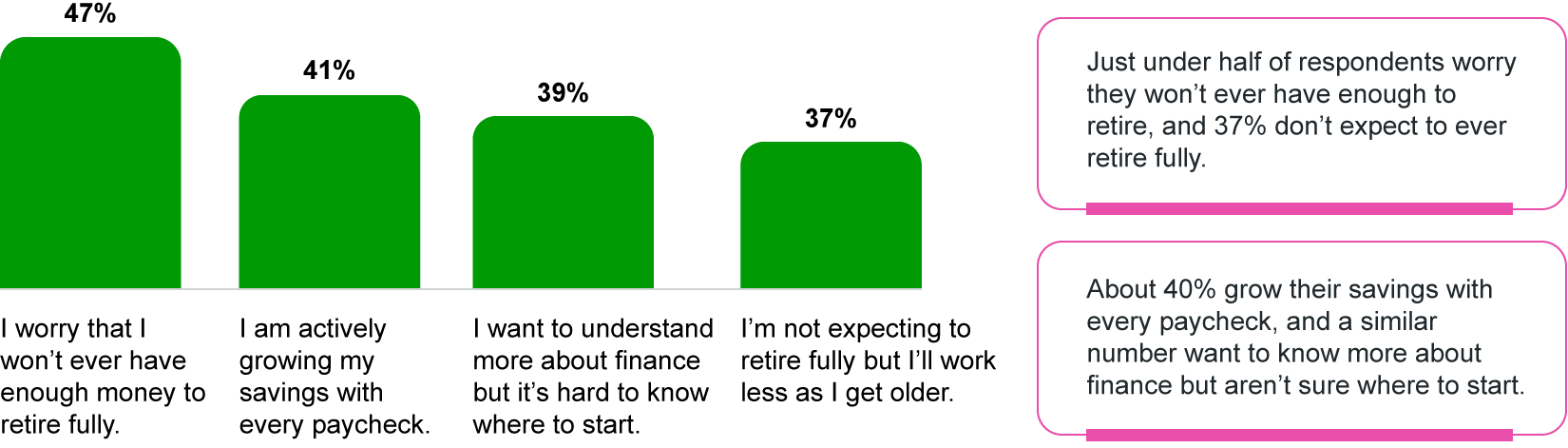

Retirement is the focus of most people's saving efforts.

Retirement isn’t certain and active saving is less common.

Ready to turn these insights into action? Connect with us today to better understand your audience and create solutions that resonate.

Methodology

These findings are from an omnibus study released by Sago among a random selection of 3,003 U.S. and Canadian adults over the age of 18. The study ran from November 12th to 24th 2024.

The results were weighted by age, gender, region, and social grade to match the population, according to Census data. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 2.5%, 19 times out of 20. Discrepancies in or between totals when compared to the data tables are due to rounding. Excerpts from this release of findings should be properly attributed, with interpretation subject to clarification or correction.

Sago is a leading global research partner that puts the human voice at the center of everything we do by providing unparalleled access to audiences, an adaptive range of qualitative and quantitative solutions, and market research expertise.